S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Diversity, Equity, & Inclusion

Investor Relations

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Diversity, Equity, & Inclusion

Investor Relations

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

S&P Global — 1 Aug, 2023 — Global

By S&P Global

Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

The US Economy – Don’t Call It a Comeback

There’s an old joke, beloved by economists, that they have correctly predicted nine of the last five recessions. The time may have come to amend that — economists have now successfully predicted 10 of the last five recessions. Although there are still worrying signs from key economic indicators, a growing consensus among economists suggests that the US may avoid the hard landing of a recession despite the Federal Reserve’s commitment to combatting inflation through rate hikes.

The big news last week was that second-quarter GDP growth came in at 2.4% annualized. Many economists had predicted that growth would slow in the second quarter after annualized first-quarter growth outperformed expectations at 2%. In June, most economists expected flat growth in the first half, but the US economy has continued to confound expectations.

On July 26, Fed officials unanimously agreed to approve another hike of 25 basis points, raising the benchmark federal funds rate target range to between 5.25% and 5.50% and pushing interest rates to the highest level since 2001. While many economists are predicting that this hike will be the final move in this cycle of rate increases, the Fed has refused to commit to a pause in further increases.

“We suspect the doors were left open for additional rate hikes also to sell markets on the ‘hawkish hold’ and limit any further easing in financial conditions, which would be counterproductive to the Fed's goals,” wrote Satyam Panday, chief economist for the US and Canada at S&P Global Ratings.

The Fed’s hawkish response to interest appears to have borne fruit. Headline consumer price inflation is running at a 3% annual rate, approaching the Fed’s inflation target of 2%. While it is possible that inflation may creep up over the next few months due to energy prices, many economists believe that it can take up to six months for rate hikes to fully impact inflation.

Consumer confidence, which remained stubbornly low through the first half, reached a two-year high in July. The unemployment rate has stayed steady at below 3.7% since this cycle of rate hikes began in 2022. According to Fed Chairman Jerome Powell, the US labor market remains "very tight," and labor demand "substantially exceeds the supply of workers." The labor force participation rate rose to 83.5% in June, the highest level since 2002.

Rate hikes are usually felt first in housing markets since the federal funds rate affects mortgages. While mortgage rates have reached their highest level in more than 20 years, the housing market has stayed hot. There was a 2.2% increase in single-family housing permits in June as housing supply struggled to keep up with demand. However, multifamily permits and existing home sales slipped in June, indicating that the market may be softening.

Today is Tuesday, August 1, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

Slowing Economic Growth Won't Dampen Australian Banks' Debt Market Activity

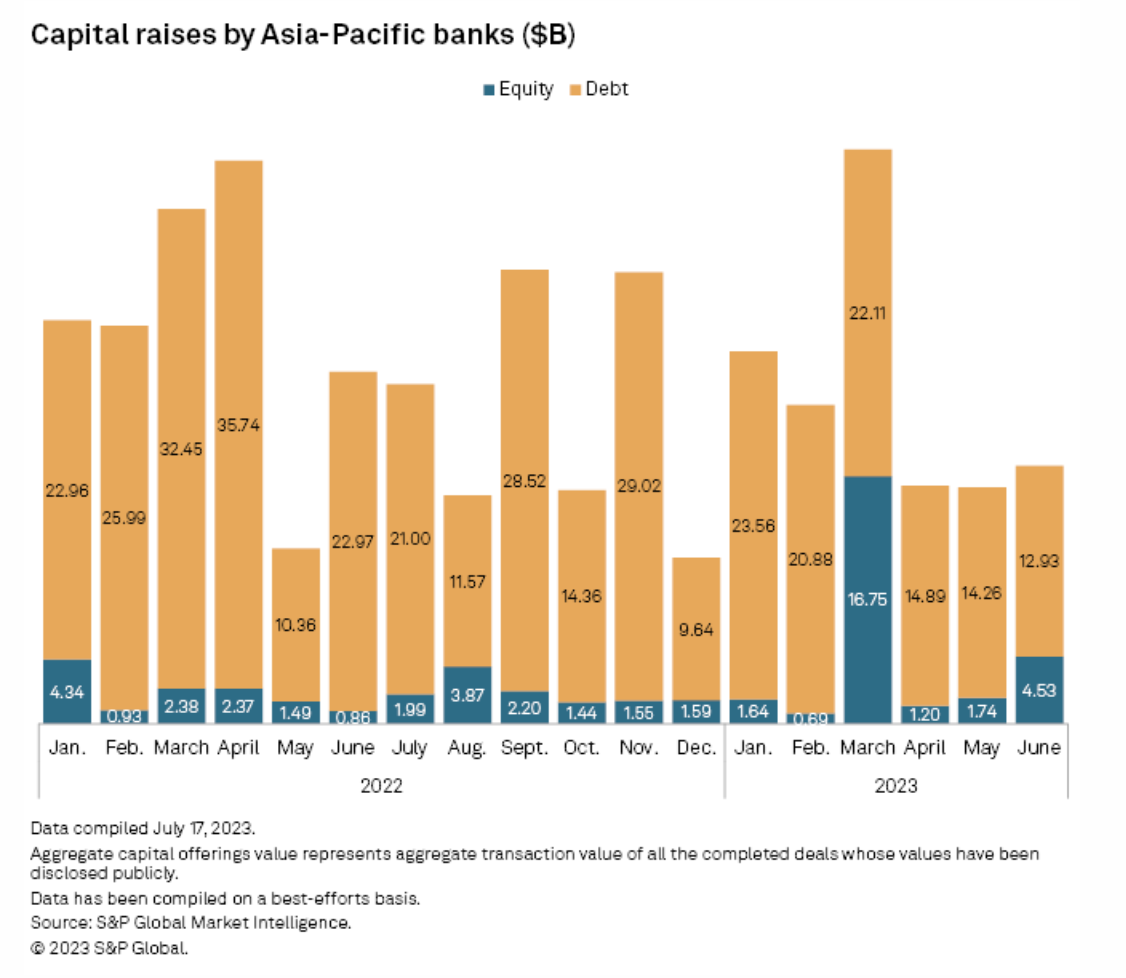

Australian banks are expected to remain active in debt capital markets, even as high interest rates dampen the country's economic growth prospects. Australian and New Zealand banks, including Commonwealth Bank of Australia, Bank of New Zealand, Westpac Banking Corp. and ASB Bank Ltd., raised $3.59 billion via debt securities in June, compared to $2.03 billion a year ago, according to S&P Global Market Intelligence data. The total raised in May was $4.23 billion.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

This Month In Credit: Glimmers Of Sunlight

The global net bias in June had its most positive move in the past year, led by a 10 percentage point increase in the Latin America positive bias following a positive outlook revision to S&P Global Ratings’ sovereign rating on Brazil. Rating action trends turned less negative in June as downgrades fell 21% from May, with speculative-grade downgrades accounting for the decline.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

Weekly Pricing Pulse: Commodity Markets Calm As Traders Await Fed’s Next Move

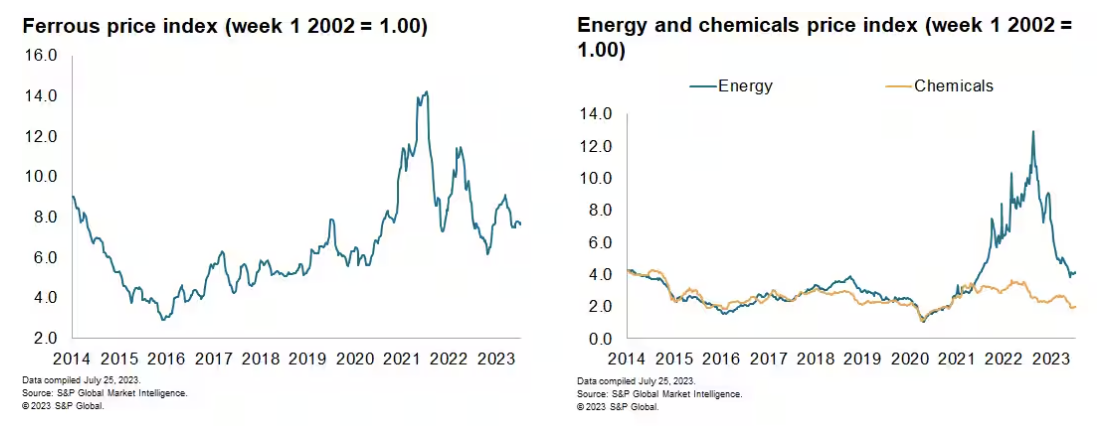

The Material Price Index (MPI) by S&P Global Market Intelligence was flat last week, following on from two consecutive weekly increases. Despite the lack of movement in the overall MPI at a headline level, there were small declines recorded in eight out of the ten subcomponents. And the story of this year has been declining prices with the index 28% lower than its year-ago level.

—Read the article from S&P Global Market Intelligence

Access more insights on global trade >

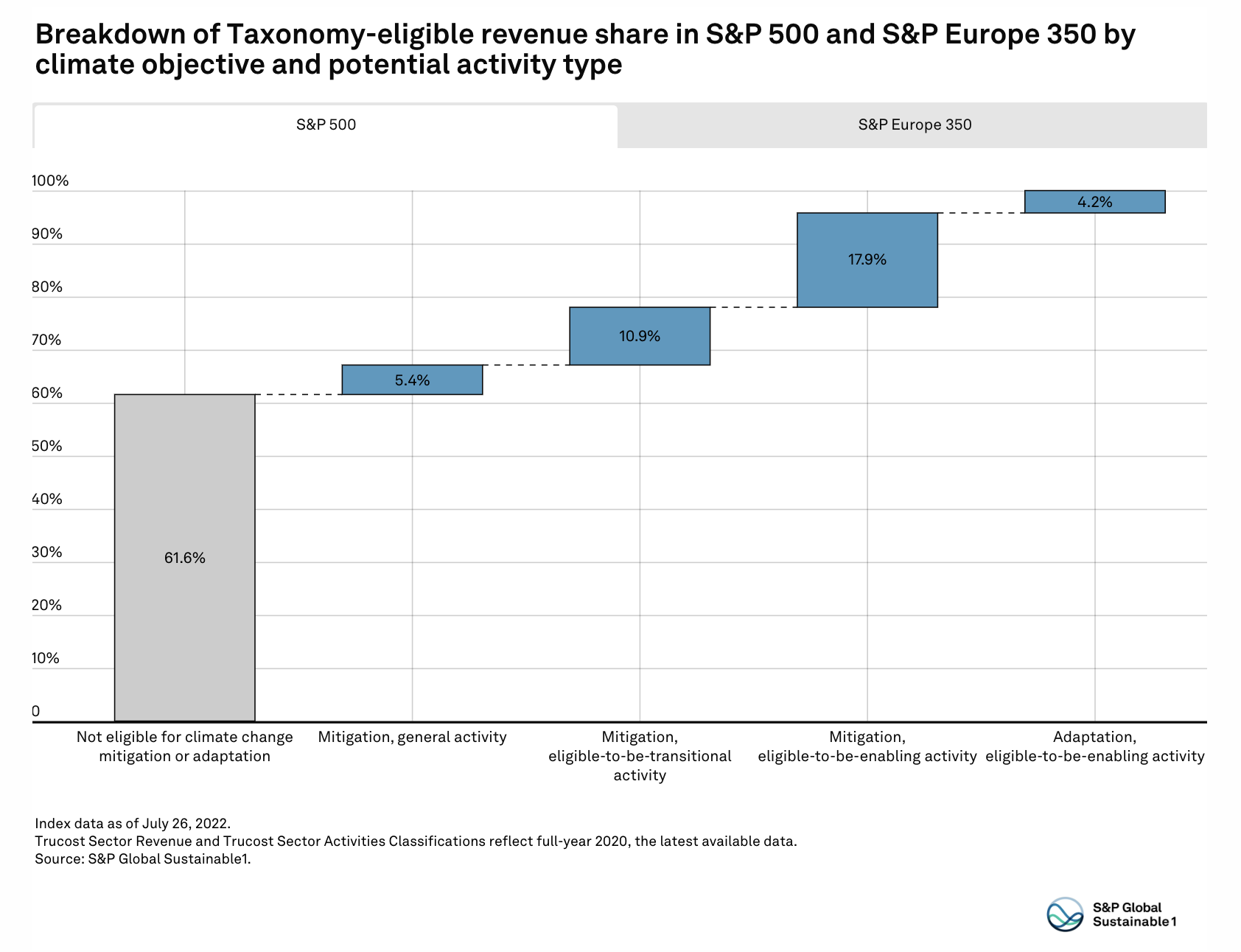

June 2023 — ISSB’s Disclosure Standards, EU’s New Sustainable Finance Package, Singapore’s Plans For Guidance On Transition Financing

Regulation is shaping the sustainability agenda and changing the way companies do business in different jurisdictions but keeping pace with constant regulatory updates has become a mammoth task for businesses and investors. In this recurring series, S&P Global Sustainable1 presents key environmental, social and governance regulatory developments and disclosure standards from around the world. In this month's update, it looks at the International Sustainability Standards Board’s first two disclosure standards, the EU’s new sustainable finance package and guidance on transition financing from Singapore’s financial regulator.

—Read the article from S&P Global Sustainable1

Access more insights on sustainability >

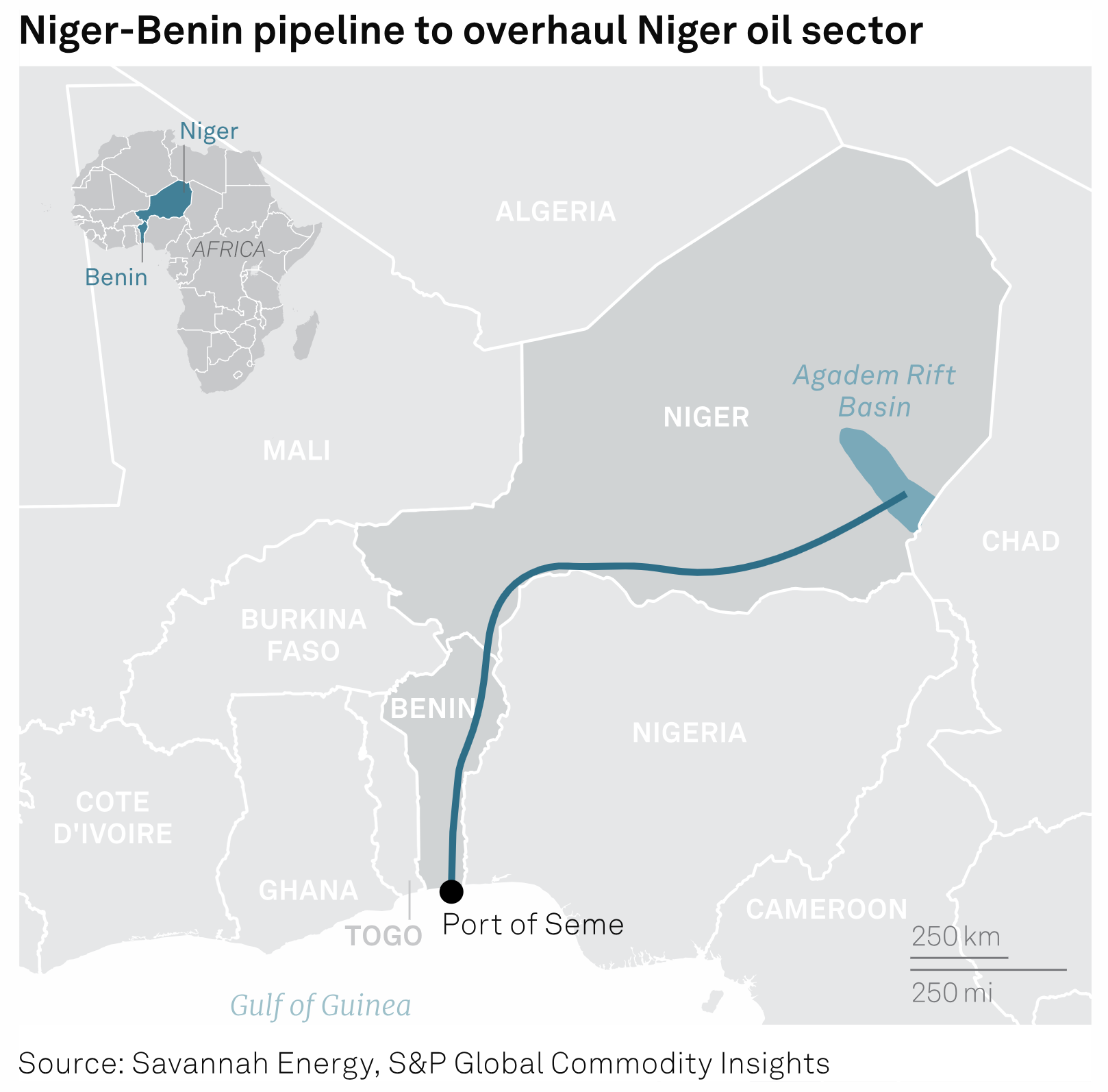

Niger Coup Could Jeopardize Oil Production Boost, Create Regional Security Vacuum

A military takeover in Niger, the latest in a string of coups to grip Africa's Sahel region, could jeopardize the African country's plans to become a significant oil producer and exporter, analysts and industry sources have told S&P Global Commodity Insights. Nigerien President Mohamed Bazoum, elected in 2021, was still confined to his home by members of the presidential guard on July 28, two days after soldiers took to state television to announce his overthrow.

—Read the article from S&P Global Commodity Insights

Access more insights on energy and commodities >

Listen: Can AI, The Metaverse Help Power The Future?

Mentions of artificial intelligence and the metaverse may conjure images of the latest video game or social media platform, but the technologies are increasingly being deployed across a wide range of industries including the energy sector. And AI is becoming an increasingly talked about issue among the federal government, with even the White House jumping in to try to start laying a framework for both seizing this opportunity and managing its risks. However, companies like Nokia are confident that the opportunities outweigh the risks and argue that AI, the metaverse and so-called digital twinning have a wide range of applications for the energy sector. S&P Global Commodity Insights senior power editor Kate Winston spoke with Thierry Klein, president of Bell Labs Solutions Research at Nokia Bell Labs, and Dominique Verhulst, global head of the utilities vertical at Nokia, about these very issues.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights