S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Diversity, Equity, & Inclusion

Investor Relations

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Diversity, Equity, & Inclusion

Investor Relations

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

S&P Global — 12 Jun, 2020

By S&P Global

With the pandemic proving some retailers to be more resilient than others, the future of the industry may lie in companies’ ability to adapt to changing consumer behaviors within a rapidly transformed environment.

"Things are extremely fluid right now in the retail sector as a whole, and that covers all retail property types," Tom Dobrowski, vice chairman of Newmark Knight Frank's capital markets group, told S&P Global Market Intelligence.

As the pandemic spread around the globe, governments made varying decisions about which retailers could remain open, deciding broadly that “other than food retailers and grocers, most fell into the category of non-essential and had to close their stores” or restrict their assortment to core offerings, according to S&P Global Ratings. Now that nations’ phased reopening plans allow many non-essential retailers to reopen, companies may see an influx of consumers eager to re-engage in daily activities with the necessary coronavirus-protection measures. In the U.S., 54% of consumers surveyed by 451 Research, part S&P Global Market Intelligence, plan to start shopping at retail stores as soon as state and local restrictions ease—but are wary of doing so too soon. Two-thirds said they planned, starting in mid-May, to pull back their spending in the next 90 days compared with the same period last year.

To be sure, it could take years for behavior to return to pre-pandemic levels and norms, especially as new coronavirus cases rise in the U.S. and around the world. Pre-pandemic concerns surrounding brick-and-mortar real estate in the face of low foot traffic and high e-commerce competition are elevated against the backdrop of prolonged store closures, thwarting revenue and liquidity. Many analysts anticipate defaults will continue for the rest of the year.

"I think it's going to be a tough couple of years," Floris van Dijkum, managing director and analyst at Compass Point, said of retail real estate in an interview with S&P Global Market Intelligence. "You're going to see rising vacancies. You're going to see pressure on rents. And in a lot of centers, there's going to be a much higher structural vacancy than what you have right now."

The pandemic’s effects on most retailers’ and restaurants’ business models will transcend the selling process, relationships with customers, and changes to assortment, supply chains, store bases, and store configurations. According to S&P Global Ratings, the sector’s credit quality is directly linked to companies’ ability to reposition themselves and “the biggest challenge will be to invest and fund this transformation while dealing not only with the pandemic, but the accelerated digital disruption most of the sector has endured in recent years.”

While the past three years have seen high rates of retail bankruptcies, the defaults of three major U.S. retail chains—J. Crew, Neiman Marcus, and J.C Penney—accelerated the sector’s default rate to a record 13.6% in May, according to S&P Global Market Intelligence. Retail defaults made up 27% of those across the S&P/LSTA Leveraged Loan Index during that month.

Between mid-March and mid-May, S&P Global Ratings took ratings actions on 80% of the rated 53 durable goods and apparel makers in the U.S.—all of which were negative, excluding one upgrade—with 30% downgraded. More than 90% of ratings have negative outlooks or are on CreditWatch with negative implications, indicating risks for further downgrades. S&P Global Ratings reported that the Mexican retailer Grupo Famsa defaulted last week.

Prospects of an Amazon-J.C. Penney deal, talks of which have surfaced in recent weeks, could reinvent retail real estate by creating opportunity for competition with other conglomerates. Bringing distinct advantages to the e-commerce arena, brick-and-mortar footprints may serve as distribution centers in harder-to-reach rural areas or even become a hybrid of a grocery store, retail showroom, and fulfillment and distribution center, experts and analysts told S&P Global Market Intelligence.

Even before the crisis, “consumers expected the ability to shop in store, online, and on mobile devices, accompanied with a range of home delivery, click, and collect options. Retailers' capability to operate omnichannel platforms will become an essential component of their competitive advantage,” S&P Global Ratings said. “Retailers will have to integrate their supply chains, warehousing, distribution, and stores into a cohesive unit to offer a seamless "phygital" (physical-digital) experience. In our view, many retailers are predominantly in the early phase of this long journey.”

"I think this is a turning point, in that you'll see a material increase in the overall deterioration of a certain set of retailers," Mr. Dobrowski told S&P Global Market Intelligence. "There's going to be a certain demographic that is going to stick to the e-commerce platform and will fade away from ... those legacy retailers that have been suffering and have not really been able to capture any type of e-commerce traffic."

Today is Friday, June 12, 2020, and here is today’s essential intelligence.

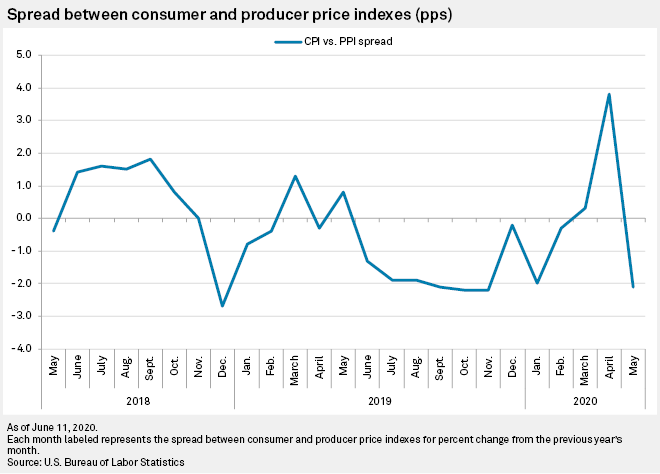

Food in Focus: Meat pushes wholesale, consumer food prices higher in May

Meat prices at both the consumer and wholesale level spiked in May as the coronavirus dealt a serious blow to capacity at U.S. processing plants. Wholesale beef and veal prices rose 78%, while consumer prices rose 18.2%, according to the U.S. Bureau of Labor Statistics. Those jumps in protein prices drove gains in the broader indices. The "food at home" component of the consumer price index, or CPI, advanced 4.8% during the month over May 2019, while the "final demand food" category of the producer price index, or PPI, notched a 6.9% gain over the same period. Grocery analysts determine the state of grocers' margins using the difference between the food-focused portions of the PPI and CPI. In May, the difference was negative by 2.1 percentage points, suggesting that grocers' margins were likely pressured during the month.

—Read the full article from S&P Global Market Intelligence

Smart cities projects emerge across largest US cities amid financial uncertainty

Smart cities project adoption continues to be slow and disjointed, as Kagan's database of smart cities programs across large U.S. cities demonstrates. This new Kagan coverage includes 68 active and planned projects across the 20 most populous U.S. cities, and demonstrates that smart cities programs are coming online on an ad-hoc basis, with no single technology vendor showing the ability to market its technology in a systematic way across major U.S. cities. In addition, the economic uncertainty and revenue challenges related to the COVID-19 pandemic will make funding planned and future projects uncertain.

—Read the full article from S&P Global Market Intelligence

2020 – The Dawn of the Passive Investing Era in India: Part One

The year 2020 has brought about many unexpected turns of events. The COVID-19 pandemic, which will be marked in history as one of the most-acute pandemics that the world has had to experience, is one. Another area that has seen a transformation in the financial investing space is the realization and acceptance of passive investing. The recent growth trends globally and in India are marking new trajectories. The global growth story in passive products has been strong and broadening, with new innovations and themes. India has played catch-up, with the exponential growth in assets in the past few years revealing the potential for the passive space in the region.

—Read the full article from S&P Dow Jones Indices

South Africa Is Yet To Turn A Corner Past COVID-19

The COVID-19 pandemic has struck South Africa at a time of very weak growth and fiscal pressures. GDP growth has taken a big hit due to strict lockdowns and markedly weaker external demand. S&P Global Ratings lowered foreign currency ratings on South Africa to 'BB-' from 'BB' on April 29, 2020. The stable outlook reflects the balance between pressures relating to very low GDP growth and high fiscal deficits, and the sovereign's deep financial markets and monetary flexibility. S&P Global Ratings anticipates that the banking sector will contract due to the economic crisis, and forecast that credit to the private sector will shrink by about 5% in 2020. S&P Global Ratings expects that the banking sector's credit losses will rise to about 1.2% in 2020, mostly stemming from defaults on retail and small-to-midsize-enterprise loans. Nevertheless, the South African Reserve Bank's liquidity measures will ensure the stability of the financial and banking sectors. We lowered our ratings on top-tier South African banks to 'BB-' in early May 2020, but their stand-alone credit profiles remain at 'bbb-'.

—Read the full report from S&P Global Ratings

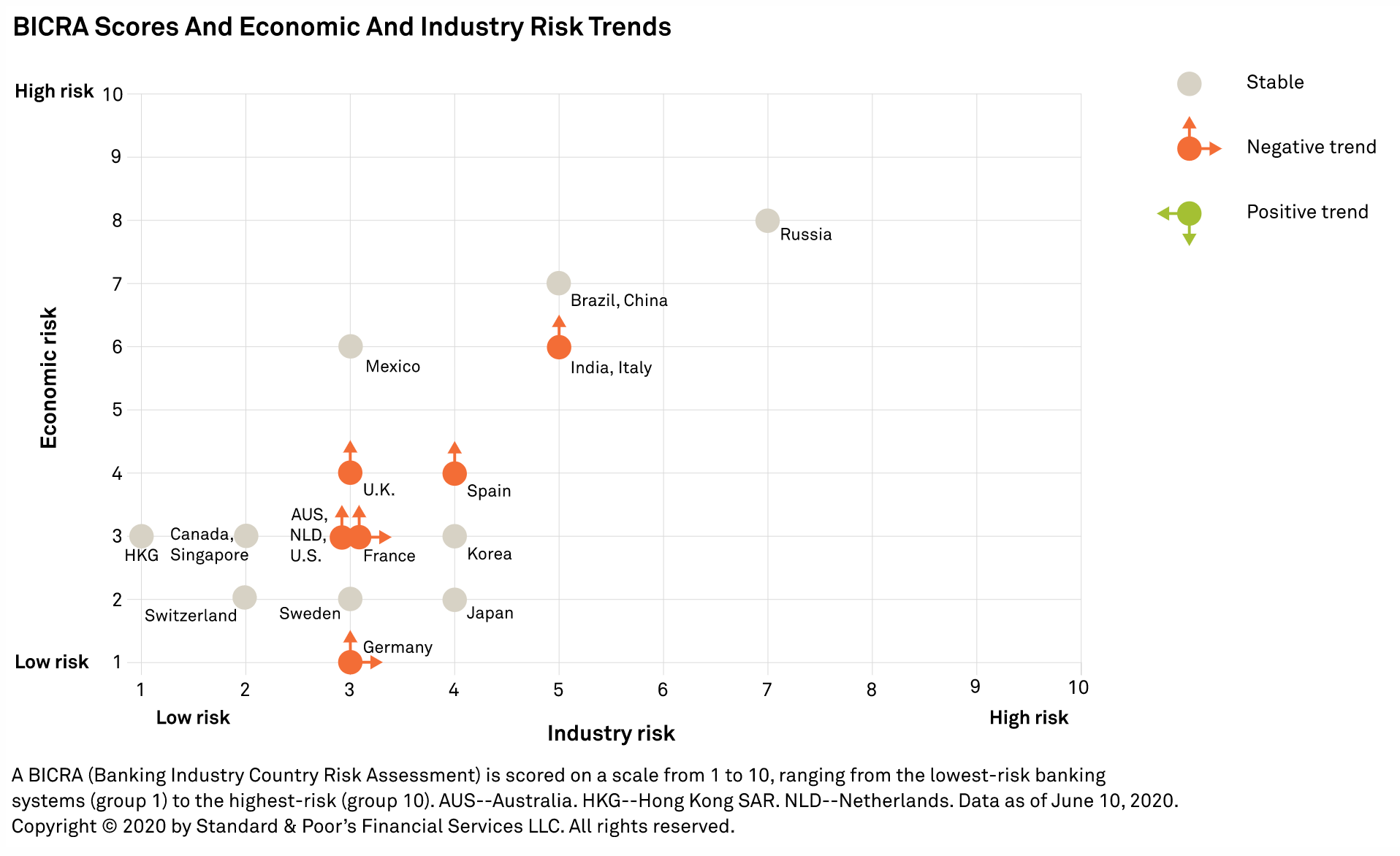

How COVID-19 Is Affecting Bank Ratings: June 2020 Update

S&P Global Ratings continues to expect that bank rating downgrades this year due to the COVID-19 pandemic will be limited by banks' strengthened balance sheets over the past 10 years, the support from public authorities to household and corporate markets, and our base case of a sustained economic recovery next year. Nevertheless, S&P Global Ratings’ outlook bias turned markedly negative since April, following the downward revision of our central economic forecasts, continued material downside risks to these forecasts, and the potential longer-term impact on banks' profitability.

—Read the full report from S&P Global Ratings

Bank Regulatory Buffers Face Their First Usability Test

Banking regulators' response to the economic shock associated with COVID-19 has been swift and decisive, and includes numerous clarifications and relief measures on minimum capital requirements and buffers. In S&P Global Ratings’ view, these measures are positive for banks. They give them flexibility to navigate the worst part of the crisis, deemed to be short-lived but acute, and are generally in line with the original intentions of these buffers. However, questions have arisen over banks' ability and willingness to use the regulatory buffers available to them. S&P Global Ratings’ ratings on banks are not point-in-time, but rather incorporate our expectations of the prospective and sustainable level of relevant metrics, combined with a qualitative assessment. Therefore, a dip in certain regulatory capital metrics does not automatically put pressure on ratings as it could signify that banks are using buffers built up specifically to respond to stresses. However, an assessment of the recovery path and the reasons for the dip will be key to determining any ratings impact.

—Read the full report from S&P Global Ratings

Indian households may tighten purse strings, adding a drag on economic recovery

Indian households, which are already scaling back on bank borrowings, may become more cautious in levering up, tempering expectations of a demand-led recovery in the world's fifth-biggest economy. Boosting credit demand remains the biggest challenge as India resumes economic activity after several weeks of lockdown due to the local outbreak of COVID-19. Banks are awash in liquidity after a series of rate cuts by the Reserve Bank of India and other measures by the authorities to revive the economy that's expected to slip into contraction this year.

—Read the full article from S&P Global Market Intelligence

HSBC faces questions over US unit as pressure mounts on CEO

As HSBC Holdings PLC CEO Noel Quinn comes under pressure to speed up restructuring, there are growing questions about the viability of the bank's U.S. operations, according to analysts. Quinn unveiled the bank's biggest ever restructuring program in February that includes slashing 5,000 jobs and a $100.00 billion reduction in risk-weighted assets. Quinn, whose predecessor John Flint was ousted after only 18 months in the job for failing to restructure the bank more quickly, said in April that the revamp would be partly "paused" due to the impact of the coronavirus. But Quinn is said to be under pressure from Chairman Mark Tucker to speed up the revamp, according to the Financial Times.

—Read the full article from S&P Global Market Intelligence

UAE banks face compliance pressure after anti-money-laundering report

Banks in the United Arab Emirates may face greater scrutiny of their anti-money-laundering measures, and thus pressure to improve compliance, following a report by a global watchdog that identified weaknesses in the country's anti-money-laundering efforts. The UAE's high volumes of cash transactions and foreign remittances, coupled with a large number of politically exposed persons and ultrahigh-net-worth individuals and its geographic proximity to a number of countries destabilized by conflict, "all expose the UAE to significant money-laundering and terrorist-financing risks," Chris McLeese, strategic account director at Dow Jones Risk and Compliance in Dubai, told S&P Global Market Intelligence.

—Read the full article from S&P Global Market Intelligence

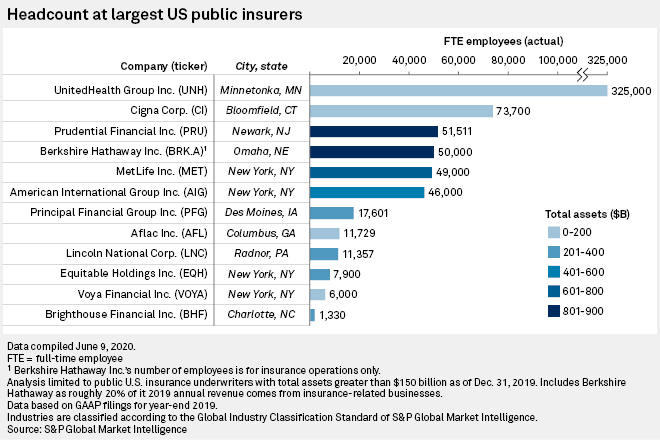

No 'big rush' by insurance companies to send employees back to offices

The largest U.S. insurers are not likely to send employees back to their offices for several more months, and even then only a fraction of their workforces will be allowed to return. Industry executives in human resource divisions are reporting that the shift to a virtual environment spurred by the COVID-19 pandemic has been successful for many companies, leading them to explore ways to expand collaboration and innovation as remote working becomes a permanent reality for some. Life insurance executives report that the sector has been able to prioritize the digitization of tools and processes that allows it to continue selling its products.

—Read the full article from S&P Global Market Intelligence

Hospitals collecting data for COVID-19 response face privacy, security concerns

Collecting and sharing data on inventories or a patient's health status has become a crucial strategy for U.S. hospitals, health systems and government agencies combating the coronavirus pandemic. Information regarding available resources like hospital beds, personal protective equipment and ventilators — most of which have been in short supply during the pandemic — have helped hospitals across the U.S. to prepare for patient surges and work around equipment shortages, according to Jason Krantz, CEO of the healthcare data company Definitive Healthcare LLC. "The [data] sharing that we've seen has really been unprecedented," Krantz told S&P Global Market Intelligence.

—Read the full article from S&P Global Market Intelligence

Corporate purchases of wind capacity set record in 2019; now totals 16.857 GW: AWEA

US commercial and industrial companies bought 4.447 GW of US wind capacity in 2019, setting a new annual record and bringing total corporate wind capacity purchases to 16.857 GW, the American Wind Energy Association said in two reports released June 11. "With U.S. wind power, companies are able to meet sustainability goals, while simultaneously securing fixed-price, low-cost energy that is protected from fuel price fluctuations," AWEA said. The reports, "Wind Powers American Business" and "Community Benefits of Corporate Wind Energy Purchases," noted that numerous corporate investments in wind "spur investment in America's rural communities."

—Read the full article from S&P Global Platts

Experts say US EPA's soot standard allows tens of thousands of avoidable deaths

A panel of independent experts has published a paper in a leading peer-reviewed medical journal that calls into question the U.S. Environmental Protection Agency's proposal to leave in place air pollution standards that allow tens of thousands of avoidable soot-linked premature deaths every year. The paper was published June 10 in the New England Journal of Medicine by former members of an independent review panel previously tasked with aiding the EPA's seven-member Clean Air Scientific Advisory Committee, or CASAC. The review panel was disbanded by EPA Administrator Andrew Wheeler in October 2018 under the disputed justification that it was preventing the agency from meeting its five-year statutory deadline to review the National Ambient Air Quality Standards, or NAAQS.

—Read the full article from S&P Global Market Intelligence

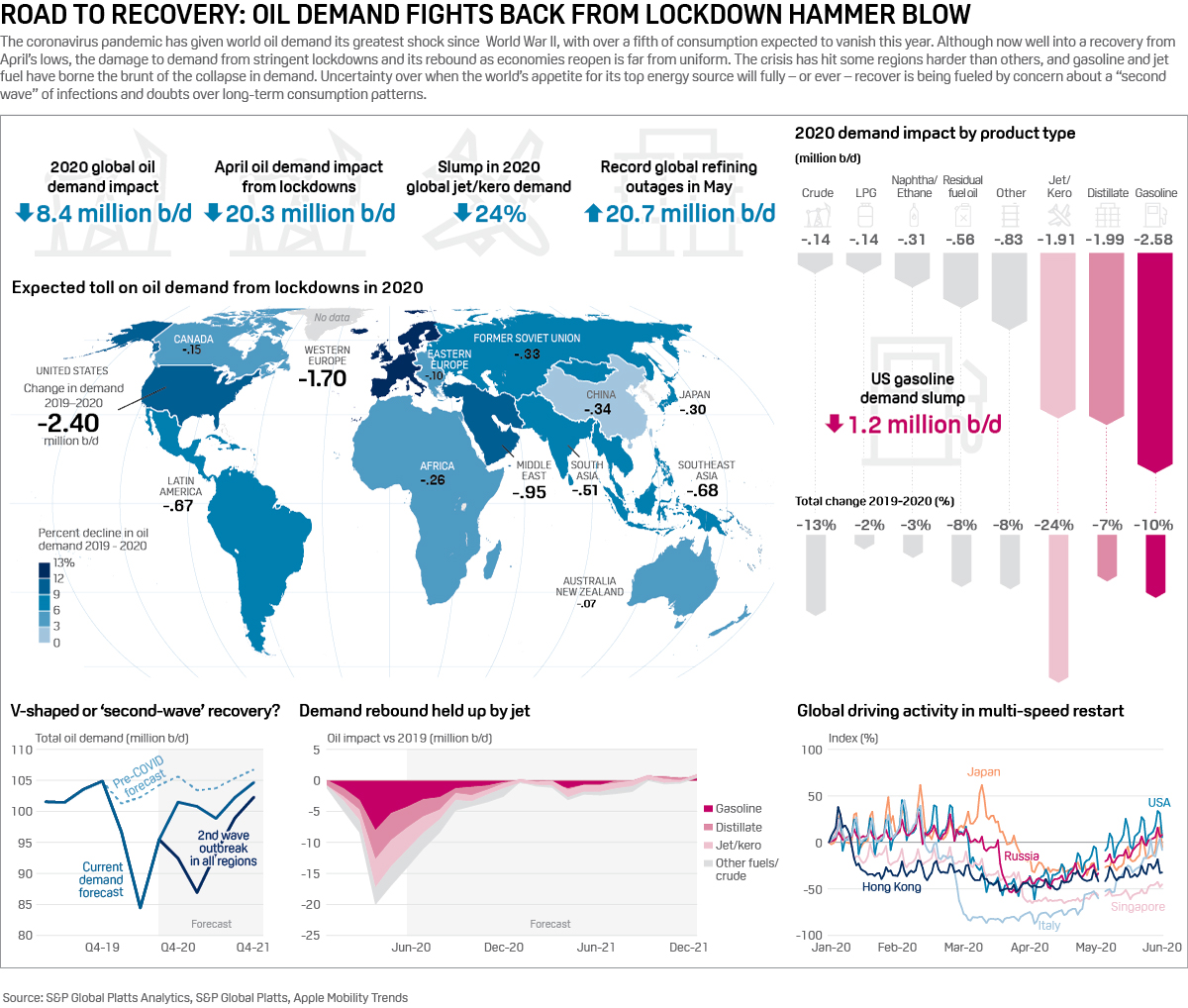

Oil demand recovery under spotlight as lockdowns ease

Optimism over a swift and steady economic rebound from crushing pandemic lockdowns have helped global oil prices stage a dizzying rebound from near two-decade lows in April. Nearly all the oil demand metrics have been encouraging so far. After bottoming out in early to mid-April, global economic indicators are improving with the exception of aviation activity which remains well below seasonal norms. Implied driving activity is already well above pre-crisis levels in both the US and Germany, Europe's biggest economy and user of fuels. In the week to June 5 alone, the US saw a surge in refined product demand to 17.57 million b/d, the strongest since the week ended March 27 when the first statewide lockdowns went into effect.

—Read the full article from S&P Global Platts

Crude futures remain lower in Asia trade as COVID-19 cases rise in US

Crude oil futures were trading lower in mid-morning trade in Asia June 12 as a rise in COVID-19 cases in the US clouded the overall outlook for oil demand recovery. At 10:10 am Singapore time, ICE Brent August crude futures were down 58 cents/b (1.50%) from the June 11 settle at $37.97/b, while the NYMEX July light sweet crude contract was 72 cents/b (1.98%) lower at $35.62/b. "A surprise stockbuild in the US last week as well as increasing concerns over a second wave of coronavirus cases in the US have been the main catalysts for oil's slide," OCBC analysts said in a June 12 note.

—Read the full article from S&P Global Platts

NYMEX WTI falls 8% as COVID-19 uptick puts demand recovery in doubt

Crude settled sharply lower June 11 amid concerns that a resurgent COVID-19 pandemic could blunt demand recovery outlooks. NYMEX July WTI fell $3.26 to $36.34/b and ICE August Brent moved $3.18 lower on the day to $38.55/b. Reports of rising coronavirus cases in several US states that have reopened their economies fostered concerns that a COVID-19 resurgence could prompt a second wave of stay-at-home measures, derailing oil demand recovery outlooks.

—Read the full article from S&P Global Platts

OPEC+ monthly talks plan meets resistance with OSP timing a concern: sources

Several delegates within the OPEC+ alliance have voiced concerns over plans for the group to meet monthly to assess production levels, casting doubt on a cornerstone of its strategy to micro-manage the market's recovery from the coronavirus pandemic-induced demand slump, sources told S&P Global Platts. Opposition is brewing within the 23-member producer group to plans for more frequent consultation after it agreed on June 6 to extend record 9.6 million b/d of output cuts through the end of July. The plan requires its influential nine-country Joint Ministerial Monitoring Committee (JMMC) — co-chaired by heavyweights Saudi Arabia and Russia — to gather monthly.

—Read the full article from S&P Global Platts

Weekly US coal production climbs to eight-week high: EIA

Weekly US coal production rose to an estimated eight-week high of 8.65 million st in the week that ended June 6, up 5.5% from a week earlier, but 30.9% lower than the year-ago week, according to a June 11 US Energy Information Administration report. It was only the second time in the last 10 weeks that all four major coal-producing regions saw weekly increases. However, the total for Week 23 was the lowest total for the corresponding week in the last 10 years, and was 38.4% lower than the five-year average.

—Read the full article from S&P Global Platts

Written and compiled by Molly Mintz.

Content Type

Theme

Location

Language