S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Investor Relations

Featured Products

Ratings & Benchmarks

By Topic

Market Insights

About S&P Global

Corporate Responsibility

Culture & Engagement

Investor Relations

S&P Global Offerings

Featured Topics

Featured Products

Events

Language

S&P Dow Jones Indices — 16 Mar, 2021

By Priscilla Luk, Arpit Gupta, and Tim Wang

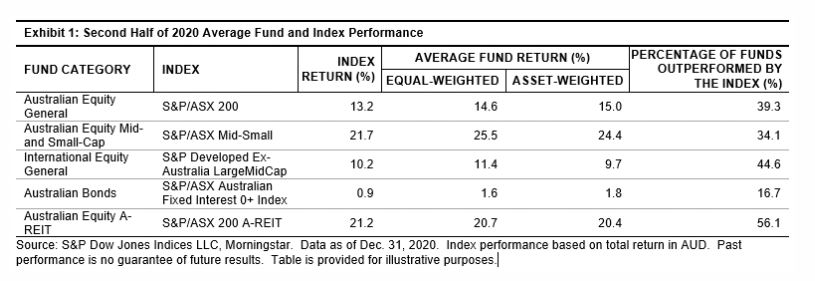

SUMMARY